SOURCE:

US Coal Prices Soar Above $200 Amid Energy Crunch | ZeroHedge

US natural gas production will need to increase to maintain soaring liquefied natural gas (LNG) exports while ensuring adequate domestic supplies for households and businesses this winter.

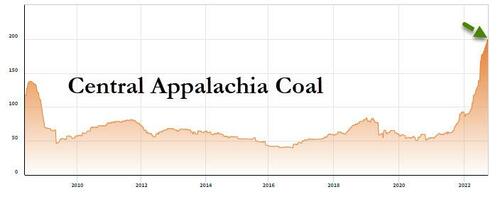

If not, then electricity generators at power plants will find NatGas uneconomical to run turbines and switch to coal-fired generators. That's precisely what could be happening as US coal prices soar over the $200 per ton mark for the first time.

*US COAL PRICES RISE PAST $200 FOR FIRST TIME AMID SUPPLY CRUNCH"

— zerohedge (@zerohedge) October 3, 2022

Bloomberg said spot coal prices for the week ending Sept. 30 increased to $204.95 per ton. Data was sourced from US Energy Information Administration, which said this was the highest price in records dating back to 2005.

The energy-market shockwaves from Russia's invasion of Ukraine and rejiggering of Europe's energy supply chain have dramatically increased US LNG exports to the EU this summer and fall. Domestic supplies have significantly tightened the availability for large users, which has pressured prices higher.

As a result, the once-mighty coal industry is returning as the global (in China and Europe) NatGas-to-coal switching could be set to intensify. The rise in coal prices may suggest stockpiling by utilities ahead of a cold winter.

Rising spot coal prices have been favorable for big coal companies: Peabody Energy Corp shares rose 6% to $26.25, and Arch Resources Inc. jumped 7.5% to $127.49. Both coal stocks have been in a lateral formation for much of this year and could break out to the upside if coal prices continue to rise.

The rally in spot coal and coal mining stocks comes under the most progressive White House ever that attempts to kill the fossil fuel industry to decarbonize the power grid with unreliable renewable power sources that have backfired. Worse, US-led sanctions against Russia have further sparked global energy market chaos.

Coal's comeback is a remarkable turnaround for an industry that was on the brink of disaster as banks halted financing and investment firms divested from mines and coal-fired power plants, though some of this has been reversed ahead of what's expected to be a cold and expensive winter.

Increasing coal generation could be a move to help offset some of the power bill pains millions of Americans are facing as NatGas prices send electricity prices higher.

There's one shocking figure by the National Energy Assistance Directors Association that shows about 20 million households across the country have already fallen behind on their utility bills.

Perhaps it's time to suspend Biden's decarbonization efforts to protect American families that could be financially slaughtered by energy hyperinflation if NatGas prices were to soar even more.

We don't believe coal will be a long-term solution for grid stability. Instead, we've reminded readers that nuclear could be a big winner in the years ahead.